By Julie Steenhuysen

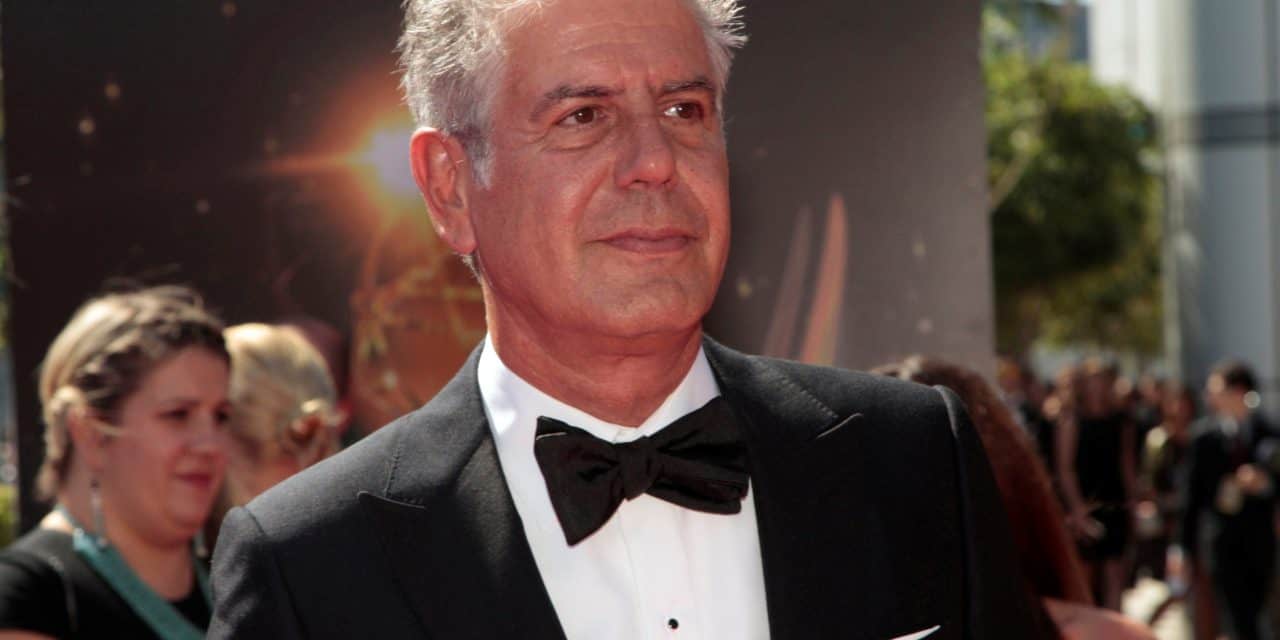

CHICAGO (Reuters) – The suicides this week of Anthony Bourdain and Kate Spade have cast fresh light on the need for more effective treatments for major depression, an area that has been largely abandoned by big pharmaceutical companies.

The news shocked fans and came as U.S. health authorities reported a sharp spike in suicide rates across the country since the beginning of the century. They called for a comprehensive approach to addressing depression and other contributing factors.

With the availability of numerous cheap generic antidepressants, many of which offer only marginal benefit, developing medicines for depression is a tough sell.

Drugmakers have 140 therapies in development targeting mental health issues, including 39 aimed at depression, according to the Pharmaceutical Research and Manufacturers of America trade group. That compares with the industry’s work on some 1,100 experimental cancer drugs, which can command some of the highest prices.

“Psychiatry has become a disfavored area for investment,” said Harry Tracy, whose newsletter NeuroPerspective tracks developments in drug treatments for psychiatric problems. “Insurers say ‘why should we pay more for a new treatment?'”

Developing antidepressants is risky. Patients in clinical trials often show a big placebo response, masking the efficacy of the drug being tested. In addition, once approved, antidepressants require a large sales force to reach psychiatrists as well as primary care providers.

Another impediment is the difficulty of conducting early depression research on animals that could form a basis for trials in people.

“This has been a big challenge to translate over to human clinical trials,” said Caroline Ko, project leader of NewCures, a newly formed program at Northwestern University aimed at reducing the risk of investment in treatments for depression, pain, Parkinson’s and other diseases.

Johnson & Johnson is the only large pharmaceutical company making a major investment in a new antidepressant, Tracy said. Smaller players include Sage Therapeutics, which expects a decision from U.S. regulators on a treatment for post-partum depression by the end of the year.

J&J’s esketamine targets treatment-resistant depression. It is similar to ketamine, which is used as an anesthetic and to relieve pain, and often abused as a recreational party drug with the street nickname Special K.

The company expects to file for U.S. Food and Drug Administration approval of esketamine this year.

Dr. Husseini Manji, global head of neuroscience at J&J’s Janssen unit, said there is great need for new treatments as about half of people with depression fail to respond to current therapies.

He believes esketamine, a rapid-acting nasal spray, will narrow the time it takes for patients to see a benefit.

“Standard antidepressants can take weeks to work. They really are not useful in a crisis situation,” said Carla Canuso, who is leading J&J’s effort testing the drug in people deemed at imminent risk for suicide, which is most commonly associated with depression.

Allergan Plc is developing rapastinel, a fast-acting intravenous antidepressant the company purchased in 2015.

The drug has breakthrough therapy designation from the FDA, with clinical trial results expected in early 2019. Last month, the company acquired another depression drug from its collaborator Aptinyx.

Dr. Julie Goldstein Grumet, a behavioral health expert from the Suicide Prevention Resource Center, said besides Bourdain and Spade, 122 people in the United States took their lives by suicide each day last week. Many were never even diagnosed with a mental illness.

“We’re missing opportunities to screen people for the risk of suicide,” she said.

(Reporting by Julie Steenhuysen; Editing by Michele Gershberg and Bill Berkrot)